Valuation Department

The role of the Valuation Department under the Belize City Council is to generate income by ensuring that all properties/ establishments be assessed on the respective Valuation Rolls in a timely efficient manner.

Introduction

- The purpose of referencing properties within the city limits is to collect facts, which are relevant to the assessment of the value of the properties, and to achieve fairness in the valuation of all properties in relation to each other.

- Referencers (Valuation Officers) must appreciate fully that in being authorized to enter into and upon private properties, they have been placed in a position of trust and must so conduct themselves in such professional manner so that, that trust will not be found to have been misplaced. Premises should not be entered unless and until the Referencer is satisfied that he has the permission of the person in possession.

The Reason for Valuation

- The word Valuation relates to the method of assessing and computing the current value of building and property etc. this is necessary so as to determine the amount of tax that the owner(s) will pay. The size, type, use, and location of building, or property, are factors taken into consideration when calculating the value.

- Valuation is a means of ------- revenue under the Towns Property Tax Chapt. 65 of the revised edition 2000. This Ordinance covers Belize City and all other district towns.

- The revenue obtained is used to provide the annual budget of the Belize City Council. It enables the Council to carry out their work program, which includes the repairing of streets, drains, bridges, lighting of streets, etc.

- Before a property is valued, there are Referencers (Valuation Officers) who undertake an on the site inspection of each property. A working list is prepared, with the name of the Street, House and Lot numbers, and the name of the owner of the property. During the inspection of the referencer he will make notes on his working list indicating whether or not the building is occupied or unfit for habitation.

The purpose for which the building is used is also indicated: e.g. Dwelling, Business, Warehouse, Club, Office etc.-

Some of the information, which has to be collected, relates to the following major areas:

- Accommodation dwelling, business, warehouse, hotel, apartments, etc.

- Construction i.e timber, concrete, block, metal, zinc, plycem, plywood, etc.

- Roof corrugated iron sheeting, concrete, shingles, fibre concrete roof tile, asbestos free (rod roofing).

- Condition and age very good, good, fair, poor, bad, very bad, dilapidated or uninhabitable

- Condition of the land, i.e filled, semi- filled, low-lying or swampy.

- Building sketch plan measurements an outline plan of each floor has to be prepared showing approximately the dividing walls and all outside measurements to the nearest feet. Letters of the alphabets are used to identify each floor of a building, and or any out- door buildings i.e., dining room, living room, kitchen, bathroom, utility room, veranda/porch, store room, etc. and type of material used for the construction of the building should be indicated by the Referencer (Valuation Officer).

- Rental Information Inspecting officers are expected to find out the rent paid for the accommodation or if owner(s) occupy the building. Information should also be obtained concerning the amount of building space available and how it is allocated i.e. shop space 264 square feet, warehouse 400 square feet, dwelling 900 square feet. Etc. These Information should be entered into the work list and then transferred to the valuation sheet or inspection sheet.

Property Tax Valuation was introduced in this Country in 1958 when Mr. I.J. Osmond, an expatriate from the United Kingdom was retained to set up said machinery. The Towns Property Tax Act, Chapter 65 of the Laws of Belize is the statute dealing with Property Tax matters in the country.

What You Should Know About Property Valuation

What is Valuation and why is it necessary?

Valuation can be defined as The art and science of estimating the value for a specific purpose of a particular interest in property at a particular moment in time, taking into account all features of the property and also considering all the underlying economic factors of the market.

Property Tax Valuation is thus the method of assessing and estimating the current value of buildings and land (i.e. lots, parcels etc.) within the Towns boundaries and City limits and it takes in account the following:-

- Location of property

- Size and type of building

- Use of property

- Size of land and other relevant factors.

Basis of Valuation

- Section 5 of the Towns Property Tax Act requires that a valuation of the value or annual value of properties within the boundaries of every town including Belize City, San Pedro and Caye Caulker be conducted and presented in a Valuation Roll. This is revised every five years.

- Thus for occupied properties, the Valuation is based on the annual rental value of the property, that is, what the property might be expected to earn as rent per year if tenanted.

- Properties that are unoccupied, that is, having no buildings thereon, are valued on the Market Value. That is, the price which the property might be expected to realize if sold in the open market by a willing seller to a willing purchaser free from all encumbrances other than rates and taxes.

- These values are then presented in prescribed form to the Local Authorities who then levy the taxes to be charged. This is usually percentage of the value or annual rental value, whichever the case may be. (RATE: Occupied 9% and Unoccupied 2%)

Properties Exempted from Property Tax

- All buildings and sites set apart and in use for public worship on which no rent is payable.

- All properties held by Her Majesty (that is Government Properties).

- All property rented in:

- a) any public body

- b) any corporate body

- c) for the public use of any town

- All schools as approved by the Chief Education Officer.

- Any building used for religious and charitable purposes.

- Any building owned by a religious denomination and occupied by a Minister of that denomination.

- All property owned by a local authority.

Often times the public at large have questions concerning their Property Taxes. At this juncture it is pertinent to discuss some of these.

- What are rates for?

- Rates are the means by which each owner or occupier of property contributes towards the cost of services provided by the Local Authorities.

- What is a Valuation Roll?

- This is a record of all rented properties in the City or Town as can be seen at the offices of the Local Authority.

- The rates people pay depend on:

- a) Rateable value or annual rental values and

- b) Rate in the dollar fixed by the local authority; usually a percentage

- Who fixes the Rateable Value?

- The Valuation Section of the Ministry of Natural Resources and the Environment which is commanded by the Chief Valuer and assisted by a Senior Valuer, Referencers and Clerks.

- How are rateable values computed?

- Most properties are inspected by referencers to determine rental values. This means that properties are valued at the figure at which it would be let from year to year in the open market. This is irrespective of whether the property is let or owner occupied, its rental value must still be assessed.

- What does the Valuation Officer take in account when assessing my property?

- All features which influences the rental value, such as location, age, type and size. Amenities such as electricity, water, etc.

- Appeals: Can an owner appeal against their assessment?

- Yes an appeal may be made against any assessment provided that the fee is paid.

- Ground for appeal: On any grounds which tend to show your property is over assessed but valid reasons must be put forward by the aggrieved.

- How does a property owner appeal?

- You should submit an appeal letter addressed to the Valuation Officer, stating the reasons/grounds for your appeal.

- What happens if we cannot agree?

- If no agreement is reached with the Valuation Officer then the case will be submitted to the Valuation Appeals Board.

Requirements to Register For A Property

- Copy of Social Security Card

- Submit a recent utility bill

- Submit relevant copies of land documents

- Complete Town Property Questionnaire

- Fill out Mailing Address Form

What Should Know About Trade License?

"Trade" means any business in the course of which any service is provided.

How can a person obtain a Trade License?

- Each person who wishes to commence a business (Trade) within the City limits shall, prior to operations, go to the Belize City Council for a Trade License Application.

- Each person who wishes to commence a business shall submit a copy of the following:

- Business Registration Certificate

- Social Security Card or Passport

- The sum of $150.00 for a special meeting

- Certificate to use premises. (Public Health)

- (A) If the business is a Limited Company we will need identification for two of the shareholders/ directors (B) Memorandum and Articles of Association of Business

- For existing businesses, renewal of the Trade License requires the Forth Schedule Application to be filled out and submitted to the clerk of the Board.

Below is a list of some of the businesses that require a Trade License:

- Real Estate Agents

- Engineers

- Building Contractors

- Architects

- Insurance Business

- Grocery Shops

- Medical Practitioners

- Apartments

- Attorneys-at-Law

- Banks

- Supermarkets

- Guest House

- Mechanics

- Hotels

- Boutique

- Laundromat

- Fast Food Shops

- Internet Café

- Warehouse

- Gas Station

Annual License Fee for Trade

The annual license fee payable in respect of the carrying out any trade shall be equal to one-fourth of the annual value of the premise in which the business is carried on.

When are fees due?

Where any fee is assessed by any board in respect of any trade carried on in any Town/City, such fee shall be payable within 30 days of the notice of assessment, and where the fee is not paid within this time a further amount equivalent to ten per centum of the balance levied every month on the principal amount.

Different Types of License:

- Commercial Travellers $100.00 per annum

- General Peddler $25.00

- Special Peddler $25.00

- Vendors Permit $25.00

- Owner/Manager of Merry-go-round

- Acrobat/ Circus Performer

- Itinerant Vendor of secrets or patient medicine and movie shows

Changing Place of Business

Any person who has a Trade License and wishes to move their business to a new location or desires to cease operation of his business must inform the Board in writing. They must give proper address of the new location so as to enable the Trade License inspector to carry out the assessment of the new location.

Transfer

No person granted a Trade License under this Act may transfer the license for such Trade without the formal approval of the Board.

Penalty for Conducting Business Without a Trade License

Where any person carrying on a Trade without a license is guilty of an offense and is liable on summary conviction to a fine not exceeding five hundred dollars, that person shall cease to carry on the business concerned. Such person shall further not be entitled either by himself or in association with others to a license to Trade for a period of two years from the date of his conviction. He shall also be liable to imprisonment for a term not exceeding two months.

Who May Appeal?

Section 18 of the Trade License Act provides that any applicant who is dissatisfied with the assessment can appeal.

Procedure to Appeal

Whenever any Board has stipulated an assessed fee in respect of any application and the applicant is dissatisfied with the assessment, the applicant may, within ten days of the notice of the assessment, serve a written notice of appeal therefrom upon that Board and upon the Magistrate of the judicial district in which the applicant propose to carry on the trade.

If the applicant does not first pay the assessed fee within the stipulated time, his appeal shall be dismissed.

Who Hears the Appeal?

The magistrate hears and determines an appeal and makes the decision.

Under what grounds may a License be Forfeited or Suspended?

A board may forfeit a license for such period as it thinks fit if the license holder:

- Is convicted of any offence involving dishonesty under Title XII of the Criminal Code, or is convicted of arson

- Is convicted of any offence under this Act, the Custom Regulation Act, the Income Tax Act or any other offence involving fraud or the revenues; or

- Is convicted for a second or subsequent offence under the Supplies Control Act.

- A board may suspend a license if the license holder is in default of payment of property tax, refuse collection fees or other fees and charges imposed by law, which are payable to the local authority, and every such suspension shall remain in force until all the outstanding taxes, fees and charges have been duly paid or satisfactory arrangements have been made with the local authority for such payment.

- Every license holder shall at all times prominently display his license on some conspicuous part of the premises where the trade or business is carried on, and every person who fails to comply with this requirement shall be guilty of an offence and shall be liable on summary conviction to a fine not exceeding one thousand dollars.

Approval of License

The Board shall have the power to:

- Hear and determine all applications for the issue of license and for the renewal of transfer thereof.

- Grant licenses,

- Forfeit licenses, and

- Do any other thing necessary to give effect to the provisions of this Act.

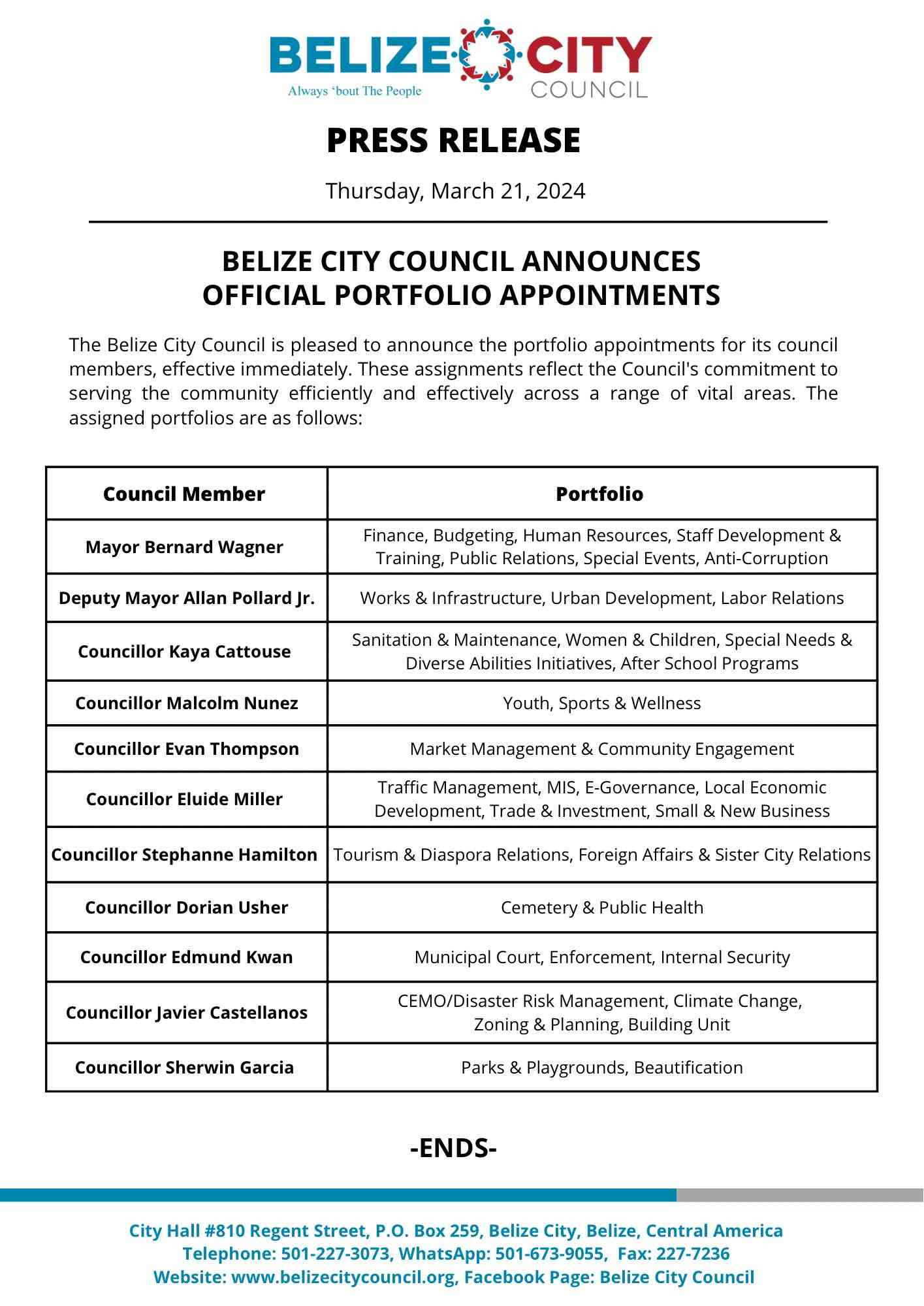

The Valuation Department is accountable to Mayor Bernard Wagner

Valuation Manager Troy Smith.

Email Address: valuation@belizecitycouncil.org